Venture Fund II

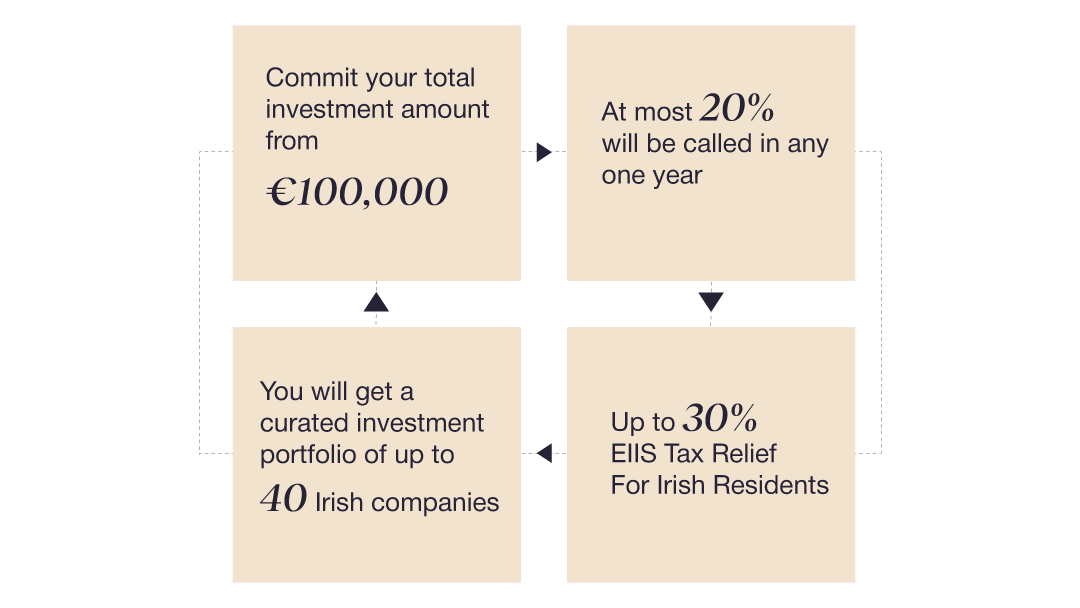

Elkstone's Venture Fund II enables investors to invest in a diversified portfolio of best in class Irish tech enabled companies while availing of up to 30% EIIS tax relief.

How does Venture Fund II work?

Why Invest Now?

Ireland’s Largest Seed Stage Venture Fund

Target High Growth Returns

With a targeted return of 15% per annum over the life of the Fund.

Big Tax Savings

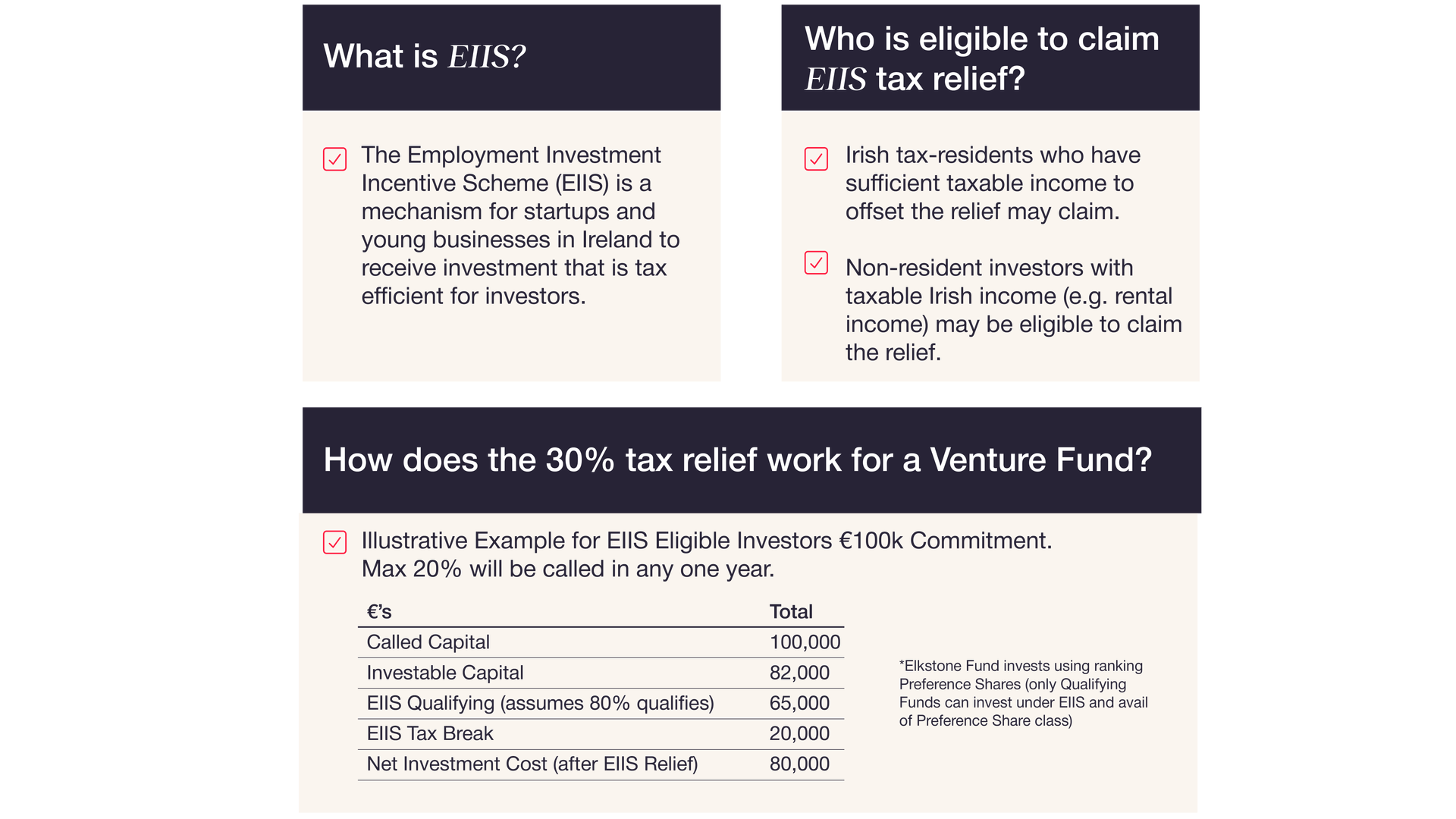

Qualifying Investments in Venture Fund II can receive up to 30% EIIS Tax Relief.

Part of Something Bigger

Investing in Irish start-up companies creates jobs and strengthen the economy, reducing Ireland’s dependence on multinationals.

What is EIIS?

Why Elkstone?

Investors choose us because of the Elkstone Edge:

Ireland’s Domestic Venture Champion

Irish specialists making a real impact within our Portfolio and to Ireland's Venture Ecosystem.

Invest with the Experts

Invest alongside institutional investors including Enterprise Ireland and the Irish Strategic Investment Fund and knowledgeable private capital and family offices.

Player of scale

Unmatched deal flow in the Irish market, with more than 90% deal to win ratio.

Proven Track Record

With 3 Unicorns (2 Irish based and 1 international company).

Unicorns

Exits

Rising Stars

Founder Series

Dive deeper into the entrepreneurs and founders from Elkstone backed companies

Contact Us

to learn more about Elkstone's investment opportunities for diversified wealth expansion.

This is a marketing communication and is intended for qualifying investors only.

It does not constitute and should not be construed as personal investment advice or a recommendation, nor should it provide the sole basis for any evaluation of the securities discussed. Elkstone recommends that specific advice should always be sought prior to investment, based on the particular circumstances of the individual investor.